Ever felt the need to check how a particular strategy would have performed in the past before putting real money on the line? That’s where backtesting comes into play. In this post, we’ll learn about the thinkorswim onDemand tool and how it can be used to fine-tune your strategy and build confidence without putting any real money on the line.

What is onDemand?

Thinkorswim is one of the more advanced trading platforms available and offers a wide variety of useful tools for traders. One of the great, but lesser-known features is their onDemand tool.

Image having a time machine for the stock market. With onDemand, you can replay market activity for any specific day, testing strategies in real-time against historical data. Beyond the obvious benefit of backtesting, onDemand also allows you to learn the platform and practice various strategies without risk.

Steps to Backtest Using onDemand

Here’s a step-by-step tutorial on how to use onDemand in thinkorswim:

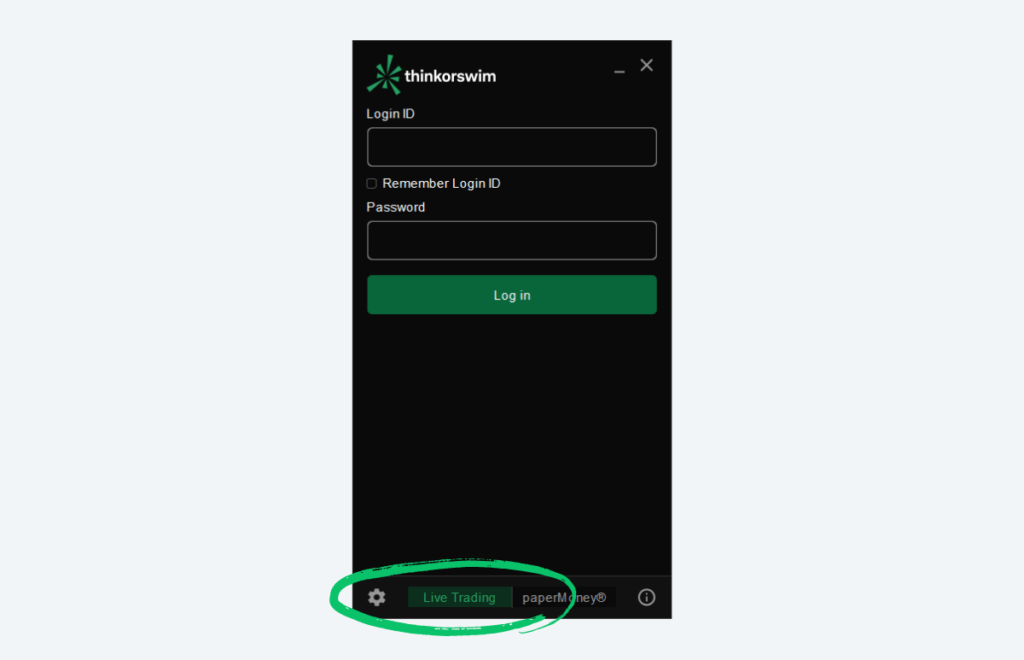

Step 1: Login to Live Account

To kick off your backtesting journey, first, log in to the live version of ThinkorSwim. The onDemand feature is exclusive to the live trading platform, so you won’t find the tool in the paperMoney version.

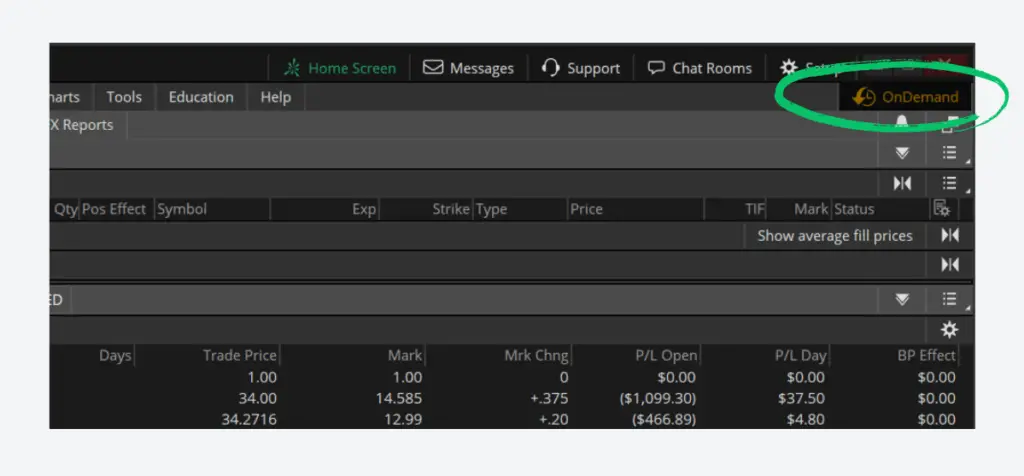

Step 2: Select onDemand

Once logged in, direct your attention to the upper right hand corner of the platform. Here, you’ll spot the onDemand button which is how you’ll access the tool.

Upon clicking it, your regular trading platform morphs into the onDemand mode, transporting you into a virtual environment sometime in the past.

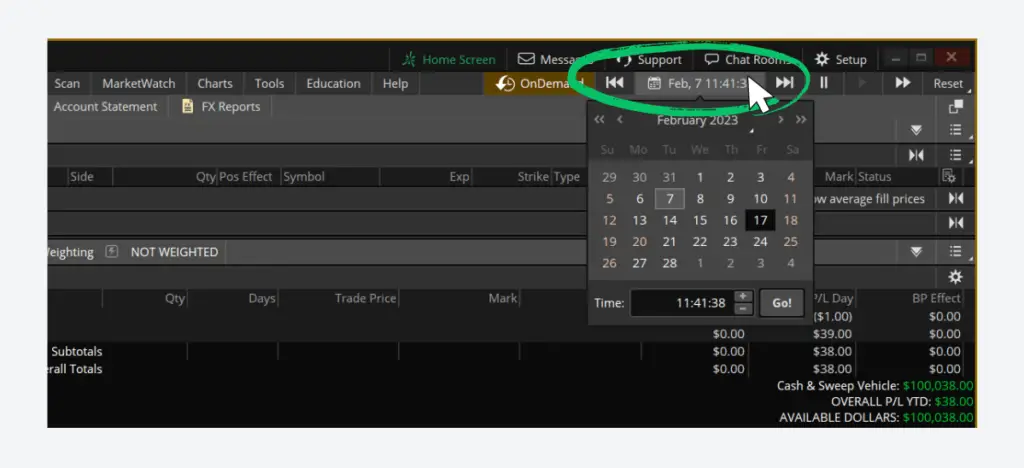

Step 3: Adjust Date and Time

Now, it’s time to select the historical timeframe you’re interested in. Notice the calendar icon also located in the upper right? Clicking this icon will allow you to adjust both the day and time you wish to load the market data for.

Step 4: Placing Trades

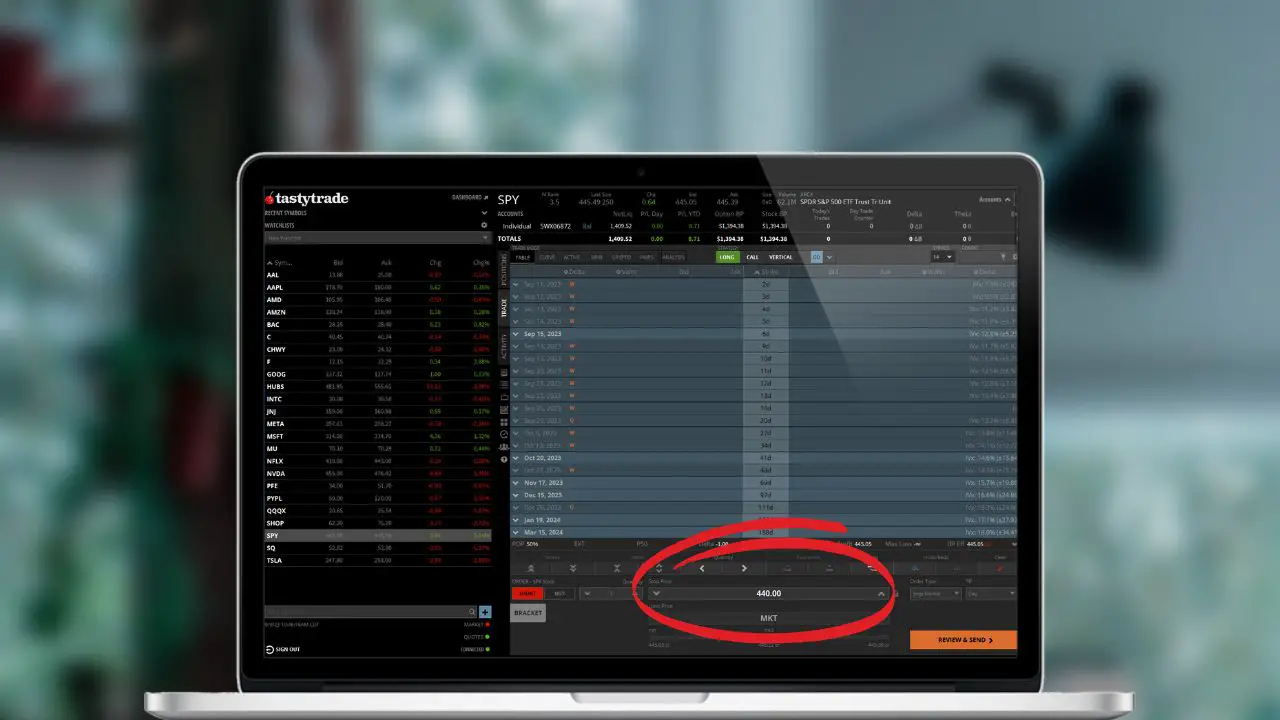

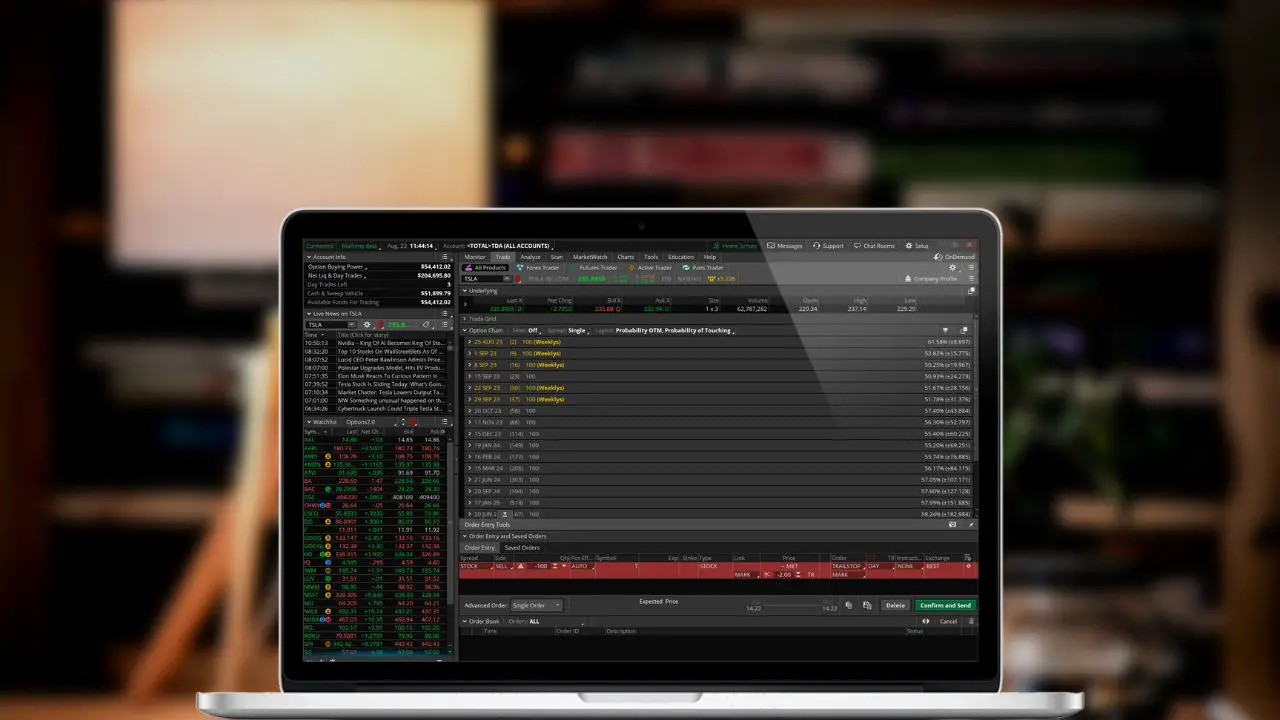

With your desired timeframe set, you’re all ready to trade. Whether you’re interested in stocks, options, futures, or forex, you can execute trades using the same order tickets. It will feel and act just like live trading because, in this virtual environment, it practically is.

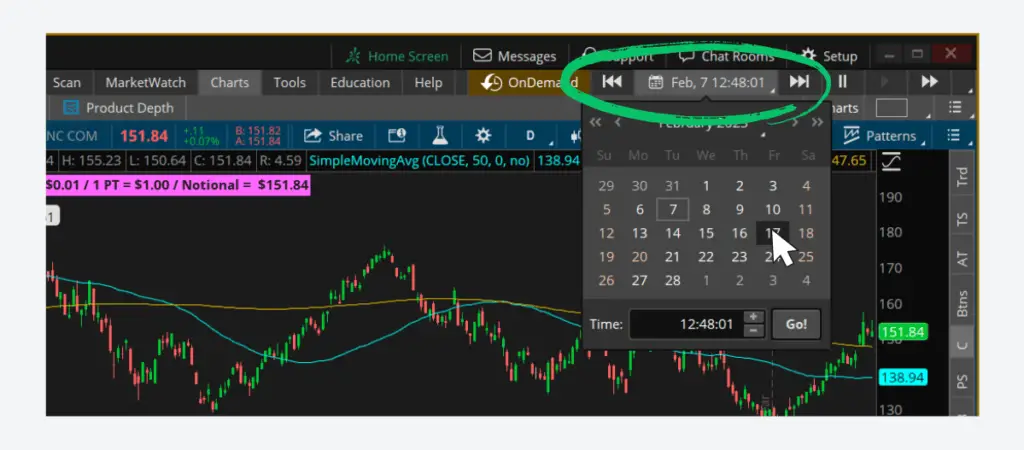

Step 5: Fast Forward and Analyze

Here comes the fun part. Once you’ve placed your trades, you might be curious about their performance. Simply head back to the calendar icon, and you can fast forward in time. This allows you to see how your trades would’ve panned out, evaluate your strategy’s effectiveness, and garner insights for future trades.

FAQs

Yes, once you have a ThinkorSwim account, the onDemand feature is available without additional charges.

As of now, thinkorswim’s onDemand can pull data back to December 2009. However, that exact range might vary based on the asset or market.

No, you can backtest as many strategies as you’d like. You can backtest strategies for forex, futures, options, and stock. The only limitation would be the historical data range and the computational power of your device.