What is an Iron Condor?

An iron condor is an options strategy composed of both a short vertical put spread and a short vertical call spread. It is a directionally neutral, defined risk strategy that does best when the underlying stock trades in a tight range.

It’s created by selling an out-of-the-money vertical put spread as well as selling an out-of-the-money vertical call spread. This means four separate options being bought and sold simultaneously and looking something like this…

- Selling a 90/85 vertical put spread: Created by shorting (selling) the 90 strike put, while simultaneously buying the 85 strike put.

- Selling a 100/105 vertical call spread: Created by shorting (selling) the 100 strike call, while simultaneously buying the 105 strike call.

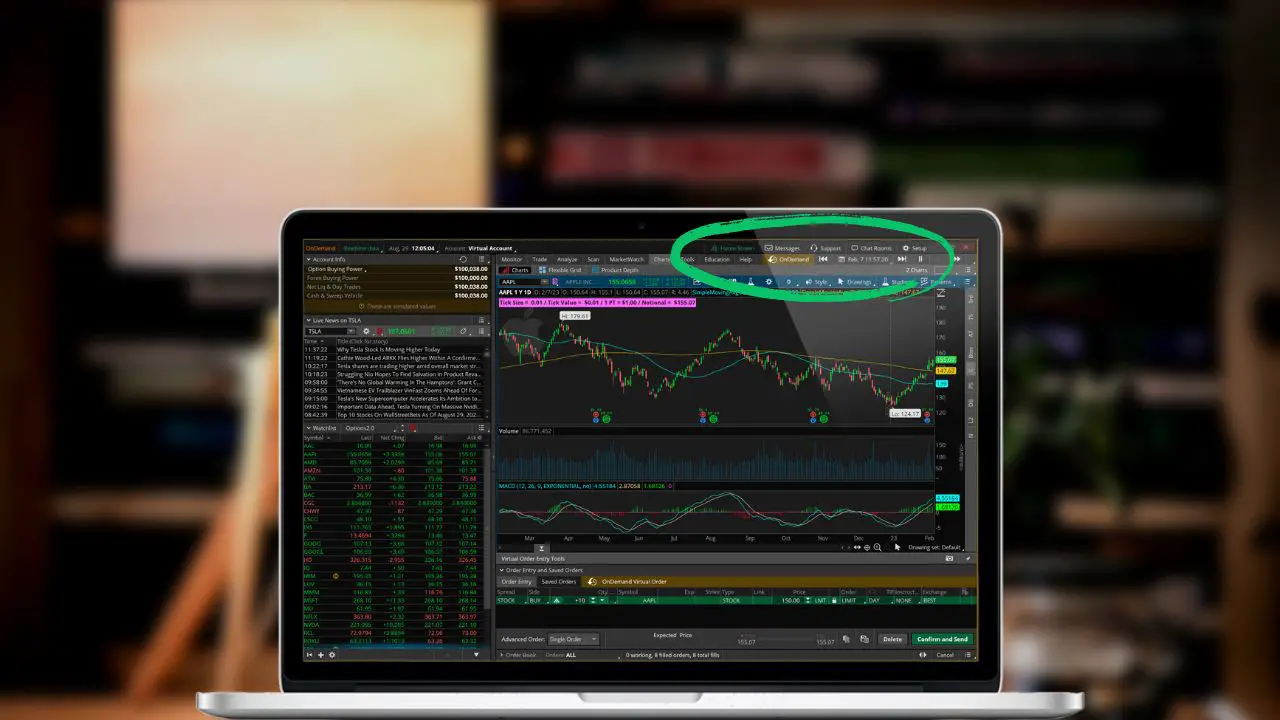

How to trade iron condors in thinkorswim web?

ThinkorSwim is one of the best options trading platforms and also completely free to use. Although the desktop version is the more widely used, the web version is quickly growing in popularity.

Despite the many similarities, all the images and instructions below will be for the web based version on thinkorswim. This will show you step-by-step how to sell an iron condor within tos web.

Step 1: Symbol search

The first thing you’ll need to do is open the trade page for the stock you intend to trade. If you already hold the position or have it added to a watchlist, this could be done by clicking the stock symbol itself.

You can also use the search box at the top of the platform. There you could type in the symbol of the stock, ETF, future, or forex pair you wish to trade.

Step 2: Option chain

After pulling up the trade page, you’ll see a variety of useful data about the stock. That’ll include stock fundamentals, a chart of recent price history, and trade buttons to buy or sell the underlying stock.

In order to trade the options or create option spreads you’ll need to open the section marked Option Chain. Clicking the arrow on the left will expand a list of all available expirations and strike prices.

Step 3: bid/ask

When you’ve found the options you want to buy and sell, you’ll use the bid/ask columns to build the order. Clicking the ask will build an order to buy the option, whereas clicking the bid will sell the option.

In the example below, we’re selling a 125/120/140/145 iron condor. We’ll create it by clicking the bid price of the 125 puts and 140 calls. After we’ll add the two wings by clicking on the asking price of the 120 puts and 145 calls.

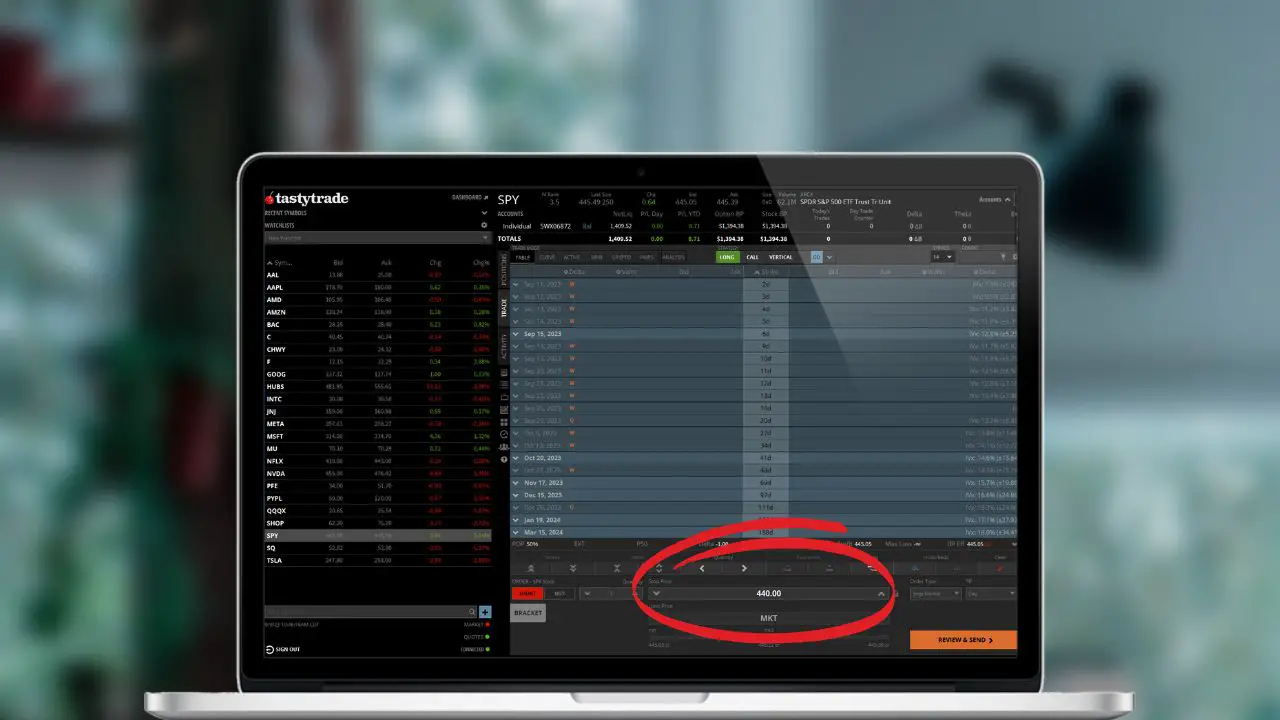

Step 4: Order ticket

The order ticket at the bottom will give a description of the trade and where you’ll make your edits. Here you would set the number of contracts you wanted to sell/buy, the price you wanted to sell them for, and the type of order you wanted to use.

In the example below, we’re selling 1 iron condor for a total credit of $2.45, $245 per spread. The ideal outcome for this trade would be for the underlying stock to remain between $125 – $140 a share (our two short strikes).

Step 5: Review and send

After adjusting the order ticket, you’ll then hit Review and Send to place the trade. Before hitting send you’ll see a confirmation window with a few more details about the spread.

In the example below, we don’t see much more than the max loss and the max profit. Since it’s an iron condor, the max profit will be the total credit received minus commissions. The max loss will be calculated by taking the width of the spread and subtracting the credit paid ($5 – $2.45).

Best practices

Unlike stock, with only two possible choices. Buy…Sell…

Options have hundreds or even thousands of possible combinations. Not only must you find the underlying to trade, but then you’ll need to find the right expiration, the right strikes, and know the ideal time to close the trade.

That’s exactly what we’ll cover next. Just keep in mind this is not an exact science, so take it all in and decide for yourself what your strategy will be.

Expiration

The ideal time frame for most iron condors will fall into the 30 – 60 day time frame. This is because time decay starts to ramp up around this time. Selling any further out in time will offer more premium, but the passage of time has so little impact it’s not worth it.

Theta (time-decay) will continue to grow as we near expiration, but if we get too close near to expiration we’ll also find ourselves more sensitive to changes in the stock price. This is known as gamma risk and is one reason many option sellers choose to close their options 21 days prior to expiration.

Strikes

There are two basic methods of picking your short strikes. That includes some form of technical analysis or by using probabilities. Some may attempt to use a combination of both to increase returns, but most will rely on probabilities.

I tend to sell options with around a 30 delta, or a probability of expiring out-of-the-money of 70%. The close you get to at-the-money the more premium you’re paid, but the greater the likelihood of being assigned.

It’ll be a fine balance, taking as little risk as possible while also getting paid as much money as possible. That’s why many options sellers consistently choose 30 delta options, believing this to be the strike with the ideal risk/reward.

When to close

It’s generally recommended to close out the spread when you reach 50 – 75% profit. Holding any longer would tie up too much capital for too little in return. Personally, I tend to close the vast majority at 50% profit and make little to no adjustments throughout the trade.

Another management technique you may hear mentioned is rolling the untested side. If the stock were to move against one side of the spread, the other side would likely be worth little to nothing at that time. You could then choose to simply close that side and then manage the losing side…or roll the untested side closer to the current price.

Moving the untested side closer to the current price would bring in more premium and hopefully offset any losses from the tested side. The downside of this being if the stock were to then reverse, you may end up in a constant state of adjustment.

Max risk

The max risk of an iron condor will always be defined at the beginning of the trade. It’s calculated by taking the width of the widest spread, minus the credit received. It would be realized if the stock is beyond either of our long options at the time of expiration.

For example, let’s assume you sold an 85/90/100/105 iron condor for a total credit of $2. Since each of the spreads are equidistant, we’ll calculate the max risk by taking the width of either spread and subtracting the credit ($5 – $2).

In the example above, the max loss on the spread would be $3, or $300. The max loss would occur if the stock was below $85 or above $105 at the time of expiration. This max loss would also be used to determine the buying power requirement on the trade.

Max profit

The max profit on all iron condors will be the total credit received when placing the trade. However, to realize the full max profit, the stock would need to remain between our two short strikes throughout the expiration.

For example, let’s assume you sold a 45/50/60/65 iron condor for a total credit of $2.10. The max profit on the trade would be $2.10, or $210 per spread. It would be realized if the stock was between $50 – $60 a share at expiration.

Recap

Iron condors are an incredibly popular options strategy to generate income. This neutral strategy does best when the stock trades in a tight range and will slowly decay over time.

After this post, you should feel far more comfortable with iron condors and how to place them within thinkorswim web. I’d always recommend you practice first, so hop into paper money and give it a try!