Bracket orders, or take profit stop loss orders are an amazing way to automate some of your trading. They allow us to set orders in advance to take profit if the stock goes up while also protecting us to the downside if things go wrong. But how do we actually do this within Webull?

That’s exactly what we’re going to learn how to do in today’s video and go through the entire process of creating take profit stop and stop loss orders. We’ll learn both the slower and more methodical approach as well as the much faster method which can do everything in one single click.

Take Profit / Stop Loss Using Order Entry

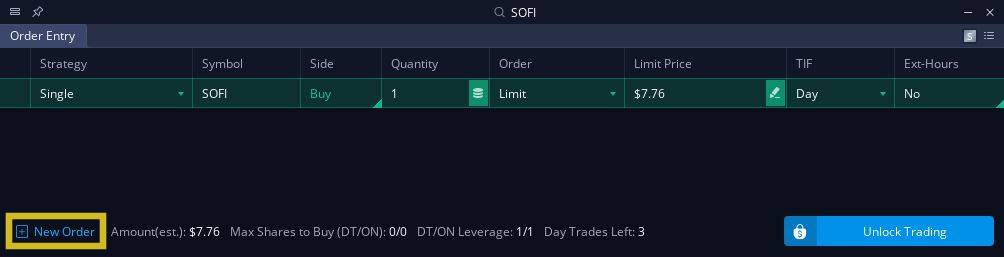

Beginning first with the more methodical approach, we’ll create a take profit / stop loss order, or OCO bracket order as it’s more commonly called, by coming down to our order entry tool right below my chart. Within the order entry tool you’ll need to look in the lower left hand corner and click the button marked “New Order.”

We’ll build out the opening trade just like normal, filling out the quantity, order type, price, and time in force. Once the opening trade is fill out you’ll move to the far left hand side of the order ticket and find the strategy button.

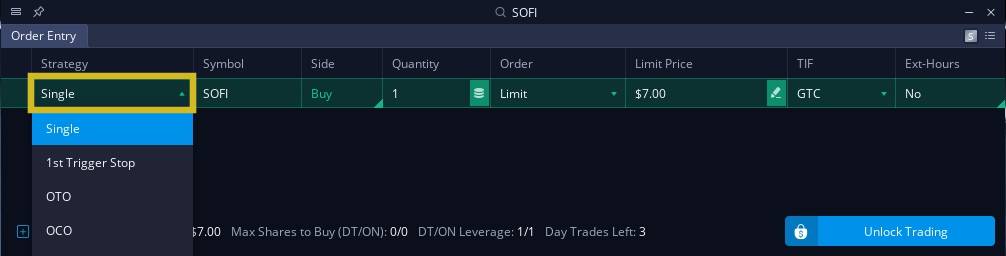

We’ll then need to select the button marked “single.”

You’ll then see all the advanced orders available right below. The options include:

- 1st Trigger Stop: When the opening trade fills, a take profit order and stop loss order are placed. When one is filled, the other is automatically canceled.

- OTO (One-Trigger-the-Other): When the original trade fills, the sub-orders will be activated won’t be affected by one another.

- OCO (One-Cancels-Other): If one order fills, the other order(s) are automatically canceled.

- OTOOCO (One-Triggers-a-One-Cancels-Other): When the original order fills, the sub-orders will be activated. Once one of the sub orders fills, the remainder of the sub orders will be canceled.

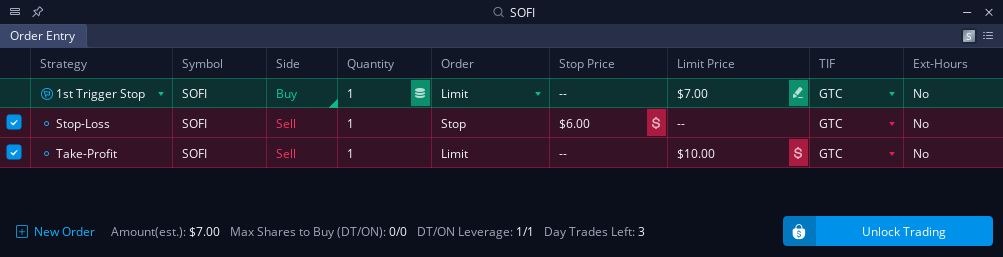

We’ll be specifically using the 1st Triggers Stop in this example to place both a take profit and stop loss order. We could also deselect one or the other if we only wanted a stop to go out, or a profit taking order to go out, but in our example we do want to use both so lets leave both checked.

Within the two sell tickets you’ll then set both your stop target and profit target. In the above example you can see the stop activation is set to $6, while the profit target is set to $10.

This is order is essentially trying to first buy 1 share of SOFI stock if it ever drops to $7. Then once that order fill, or if it ever fills, the two sell tickets will then activate. The stop to get us out if the stock then drops to $6 a share and the limit to sell if it ever goes up to $10.

Whichever of those two sell tickets fill first, the other is automatically cancels.

So again, an incredible simple way to automate your trading.

Take Profit / Stop Loss Using Percentage Targets

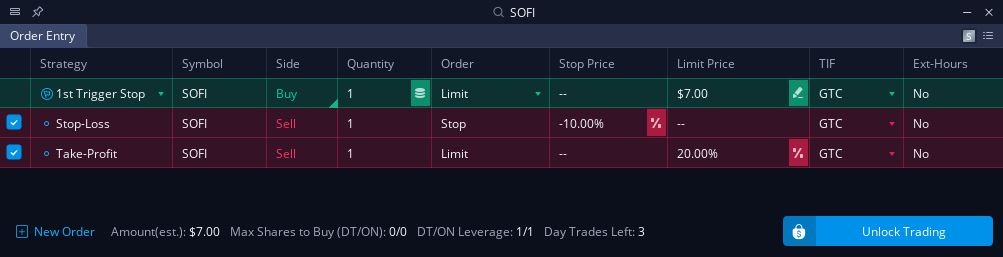

In the previous example we specified an exact price for both the profit target and the stop loss. However, we also have the ability to set a predefined percentage target for either the stop or limit.

In the example above you can see the stop has been set to a 10% offset while the limit is 20%. Since the opening trade is set to activate at $7 per share, that would mean our stop would be entered at $6.30 and our limit to sell at $8.40.

Final thoughts

As you can see, these take profit / stop loss orders can be an incredibly simple way to automate some of you’re trading. Hopefully after all that you feel much more comfortable with how to place bracket orders on the Webull Desktop Platform.