An Option Collar, sometimes called a “hedge wrapper,” is an options strategy used to protect against significant losses, while also setting a limit on potential profits. Instead of simply owning shares of stock, using a collar combines a protective put with a covered call.

This setup allows you to remain bullish on the underlying stock while also providing downside protection and potentially even earning income.

What Is an Option Collar?

A collar is created by simultaneously buying a put option and selling a call option on an asset you currently own. It’s designed to provide protection but at a much lower cost than a standard protective put. It can be particularly useful for those trying to guard against extreme volatility but are also willing to cap their upside profit potential in exchange for this downside protection.

As its name suggests, an option collar can be visualized as a “collar” around the current stock price. The purchased (long) put acts as a floor, ensuring that if the stock price falls sharply, you can still sell the stock at the put’s strike price. The sold (short) call, on the other hand, sets a ceiling, which means if the stock rises beyond this price, you may have to sell the stock at the call’s strike price.

Here’s how you set it up:

- Own the Stock: First and foremost, you must own the stock in question. These might be shares you’ve held onto for a while or ones you’ve recently purchased.

- Buy a Put Option: This component of the collar provides downside protection. It gives you the right to sell your asset at a specific price (the strike price of the put). If the stock’s market price falls below this level, you can still sell it at the higher strike price, thereby limiting your losses.

- Sell a Call Option: This is the second part of the collar. By selling a call, you agree to sell the underlying asset at a specified price (the call’s strike price) if it reaches or exceeds that level. The premium received from selling this call can offset the cost of buying the put, sometimes entirely.

Potential Risks and Rewards

Like everything, collars have their own benefits and drawbacks. The primary advantage is the assurance it provides. No matter how far the stock price might fall, you have the ability to sell at a predetermined price.

However, there is a trade-off. The premium from the call you sold might offset the cost of the put option, but this means capping your potential gains.

- Profit: Earnings can be derived from the appreciation of the underlying stock, though these are capped by the sold call option. The net profit will be the rise in the stock’s price minus the cost of the put and plus the premium received from the call.

- Loss: If the stock’s price remains stable, the primary loss would be the cost difference between the bought put and the premium received from the sold call. If the stock’s price surges past the call’s strike price, you might miss out on potential higher profits since you might be obligated to sell the stock at the call’s strike price.

Real-Life Examples

To grasp the concept better, let’s go through a few real-life examples and potential outcomes:

Example 1: Option Collar on Microsoft

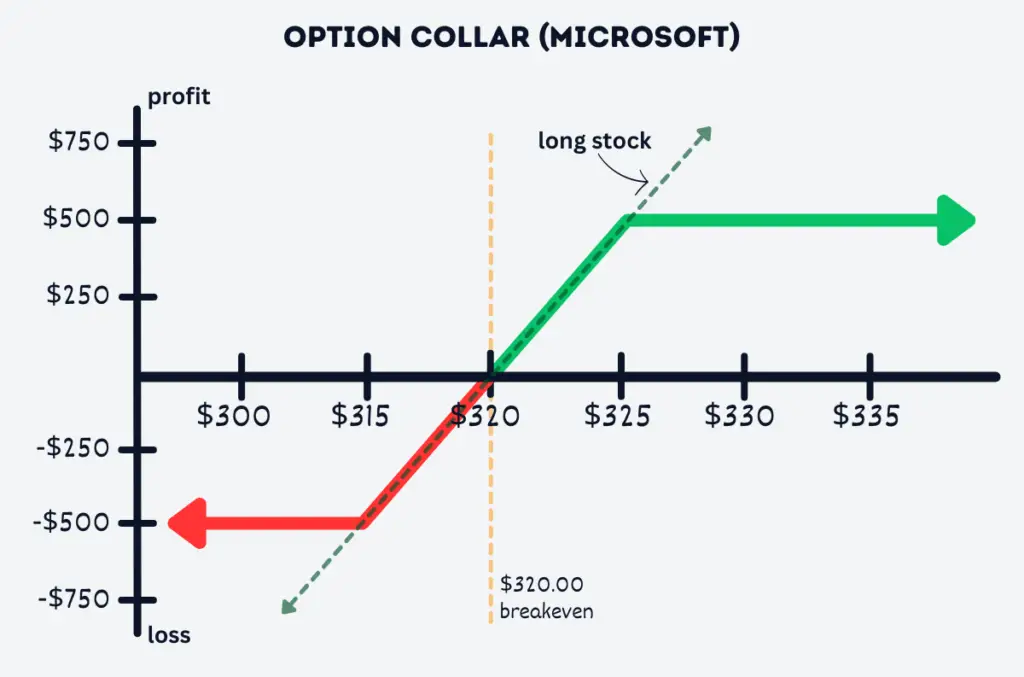

Let’s assume you currently own shares of Microsoft trading at $320. You decide to place a collar around the position in order to hedge against a potential down move.

- Holding Microsoft Shares: You currently hold Microsoft shares valued at $320 each.

- Buying a Put Option: Worried about a short-term drop in the stock price, you purchase a put option with a strike price of $315, costing you $10 per share or $1,000 for one contract (100 shares).

- Selling a Call Option: To offset the cost of the put, you sell a call option with a strike price of $325. You receive a premium of $10 per share or $1,000 for the contract.

In this scenario, the cost of the put is completely covered by the premium received when selling the call. You’ll also hear this referred to as a “zero-cost collar.“

Now, let’s review potential outcomes:

- Outcome A (Bearish Move): Microsoft’s price drops to $300 by expiration. Your stock has dropped in value by $20 per share, but the put option you bought is now worth $15. Factoring in both the put’s cost and the premium from the call option, your net loss is limited to $5 per share or $500 in total.

- Outcome B (Bullish Move): Microsoft’s price soars to $335. Due to the call option you sold, you are obligated to sell the stock at $330, which caps your gain to $10 per share. Considering the collar was created for zero cost, you’re left with a total profit of $1,000.

- Outcome C (Sideways Movement): Microsoft remains at $320 by expiration. The options on both sides expire worthless, leaving your position sitting at the break even point. No profit or loss on the trade.

Example 2: Option Collar on Amazon

For this scenario, let’s assume you currently hold shares of Amazon at $140 per share. To hedge against potential short-term volatility you decide to:

- Holding Amazon Shares: You’re currently holding shares of Amazon at $140 per share.

- Buying a Put Option: Concerned about a market downturn, you buy a put option with a strike price of $135 at a cost of $6 per share or $600 for a contract.

- Selling a Call Option: To help with the put’s cost, you sell a call option with a strike price of $150 and receive a premium of $4 per share or $400 for the contract.

In this example, the cost of the put was partially offset by the premium received from selling the call. It results in a net debit of $2, or $200 in total.

Let’s now explore potential scenarios:

- Outcome A (Bearish Move): Amazon’s price drops to $130 by expiration. Your stock value has decreased by $10 per share, but your put option is now valued at $5. Taking into account both the put’s price and the premium received from the short call, your net loss equates to $7 per share or $700 in total.

- Outcome B (Bullish Move): Amazon’s price jumps to $155. Due to the short call, you’re forced to sell the stock at $150, capping your gain at $10 per share. When factoring in the net cost of the collar, your remaining profit is $8 per share or $800 in total.

- Outcome C (Sideways Movement): Amazon’s price stays at $140. Both options expire worthless, leading to a net loss of $2 per share or $200 in total (cost of the collar).

Pros and Cons of Collars

A collar can be an excellent way to hedge your stock for an affordable price. However, like all things, it comes with its own set of advantages and drawbacks. Let’s dive into those below:

Pros of Using Collars

- Downside Protection: The primary advantage of the collar is that the protective put provides a floor. This means that even if the stock’s price plummets, you have a predetermined minimum selling price.

- Reduced Costs: By selling a covered call, you receive a premium. This premium can help offset the cost of buying the protective put, potentially allowing you to establish the collar for little to no cost.

- Predictable Outcomes: A collar defines both the maximum profit and maximum loss for your position. This can be beneficial if you want to have a clear understanding of the risk-reward on the trade.

- Flexibility: Collars can be tailored to fit specific outlooks and risk tolerances by adjusting the strike prices and expiration dates of the options.

- Income Generation: If the stock’s price remains below the strike price of the covered call, the call option will expire worthless. This allows you to retain the premium received, which could provide additional income if done for a credit.

Cons of Using Collars

- Capped Upside Potential: The biggest drawback of a collar is that your profit potential is capped at the strike price of the covered call you sold. If the stock surges beyond this price, you won’t participate in any additional upside.

- Potential Opportunity Cost: If the stock remains stable or moves sideways, the protective put might expire worthless, which might feel like an unnecessary expense, especially if the premium from the covered call doesn’t fully offset the cost of the put.

- Complexity: For beginners, managing multiple option positions can be challenging. There’s a learning curve involved in understanding how to set up and adjust collars effectively.

- Tax Implications: Depending on how long you held the position, there may be different tax consequences for short-term versus long-term holdings and for the premiums received from selling options.

- Assignment Risk: If the stock’s price exceeds the covered call’s strike price, the call might be exercised. This means you would be forced to sell your shares at the strike price, potentially missing out on further upside.

- Potential Costs: Depending on the strikes you pick, the premium received from the short call might not fully cover the cost of the put. If done for a debit, this additional cost can begin to eat away any potential gains from stock appreciation.

FAQs

While both strategies aim to protect against downside risk, a collar also involves selling a covered call, which can generate premium income to offset the cost of the protective put. However, this means capping the upside potential, unlike using just a protective put.

A collar is primarily used to protect against downside risk in a specific stock, especially during times of heightened market uncertainty, while also reducing or eliminating the cost of this “insurance.”

If the stock price surpasses the covered call’s strike price at expiration, your shares could be called away. This means you’d sell the stock at the call’s strike price, missing out on any additional gains above that level.

Not necessarily. The premium received from selling the covered call can offset the cost of the protective put. In some cases, depending on the strike prices chosen and market conditions, the collar might be done for a net credit or a net debit.

If the stock price stays below the covered call’s strike price and above the protective put’s strike price, both options would expire worthless. Any premium received from the call would offset the cost of the put, leading to a net gain or loss based on those premiums.