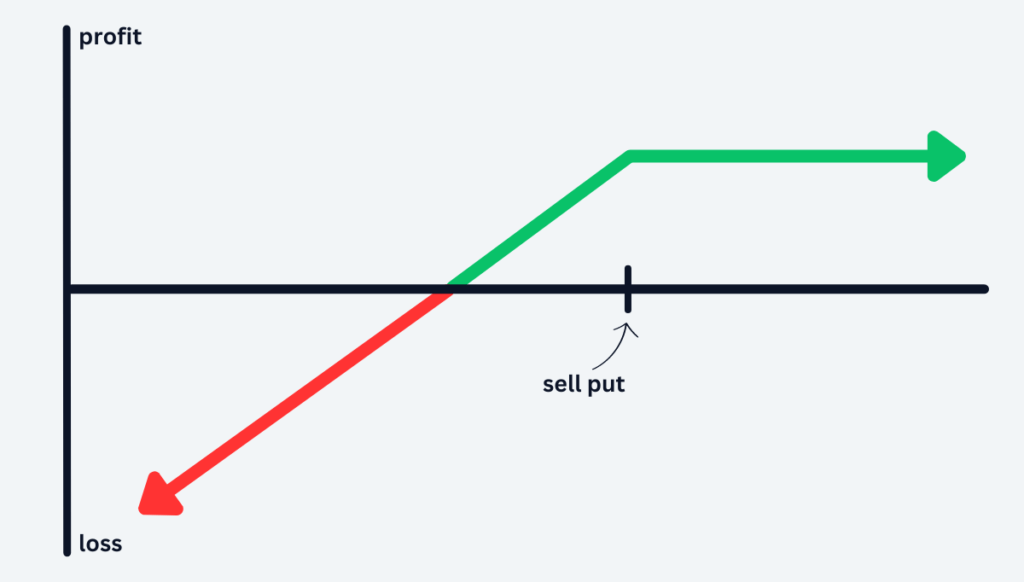

A Naked Put, also known as an Uncovered Put, is an options strategy used to generate income from a neutral to bullish move in a specific stock. It’s created by selling a put option, which provides the seller income in the form of premium.

However, this short put also comes with a high degree of risk. The seller of the put may be forced to buy the stock if it drops below the option’s strike price.

What Is a Naked Put Option?

As already mentioned, a naked put is a neutral to bullish options strategy. It’s created by selling a put option without the protection provided by another offsetting position.

By selling the put, you receive a net credit or premium, essentially being paid for taking on the obligation to potentially buy the stock at the options strike price. This creates a high level of risk since losses are undefined. The max loss only occurs if the stock drops to $0.

It’s pretty simple, but here’s how it’s done:

- Sell a Put Option: A trader sells a put option on a specific stock, hoping it won’t fall below the strike price. If it does, they’ll be obligated to purchase the stock at that strike price.

Potential Risks and Rewards

A naked put is a strategy with undefined risk and defined reward. Its goal is to generate income from time decay while having a neutral to bullish outlook on the underlying stock.

However, the inherent risk lies in the potential for the stock to drop significantly in value. Without any long options to mitigate the risk, it could result in significant losses.

- Maximum Profit: This is limited to the premium received from selling the put. You achieve this if the stock closes above the put option’s strike price at expiration.

- Maximum Loss: The max loss for a naked put occurs if the stock price falls to $0. This can be calculated by taking the difference between the breakeven point and the current stock price.

- Breakeven: This can be calculated by subtracting the premium received from the options strike price. If the underlying stock’s price is above this breakeven point at expiration, the trade will be profitable. If below, it will result in a loss.

Real-Life Examples

To see how it works in practice, let’s go through a few real-life examples and potential outcomes:

Example 1: Naked Put Option on Apple

Assume that Apple is currently trading at $180. Expecting the stock to remain above this price, you decide to sell the following naked put:

- Selling the Put Option: You decide to sell a put option with a strike price of $175. For this, you receive a premium of $4 per option. This gives you a credit of $400 for the contract (100 shares).

Based on the credit received and the strike price chosen, we can calculate the following values:

- Max Profit ($400): This is the premium received from selling the put option, which is realized if the stock price stays above the strike price of $175 at expiration.

- Max Loss ($17,100): This is if the stock price drops to $0. Calculated by the strike price of $175 minus the $4 premium, multiplied by 100 shares.

- Breakeven ($171): Calculated by subtracting the premium received ($4) from the strike price ($175). The stock needs to be at this price at expiration for the trade to neither make nor lose money.

Let’s consider a few potential outcomes:

Outcome A (Slight Bearish Move): If Apple’s stock price dips slightly to $178 by expiration, the put option expires worthless since it’s out-of-the-money. You get to keep the entire premium, leading to a profit of $400.

Outcome B (Significant Bearish Move): If Apple’s stock plunges to $170, the put option is in-the-money by $5. Since you received a $4 premium initially, your net loss is $1 per share or $100 in total.

Outcome C (Massiv Bearish Move): If Apple’s stock drops to $150, the put option is in-the-money by $25. After considering the $4.00 premium you received initially, your net loss stands at $21.00 per share or $2,100 in total.

Example 2: Naked Put Option on Tesla

For this next example, let’s assume you’re slightly bullish on Tesla which is currently trading at $220. You decide to be cautious and sell the following out-of-the-money put:

- Selling the Put Option: You sell a put option with a strike price of $200, collecting a premium of $3.00 per option. This gives you a credit of $300 for the contract (100 shares).

Based on the credit received and the strike price chosen, we can calculate the following values:

- Max Profit ($300): This is the premium received from selling the put option, which is realized if the stock price stays above the strike price of $200 at expiration.

- Max Loss ($19,700): This would occur if the stock price drops to $0. It’s calculated by the strike price of $200 minus the $3 premium, multiplied by 100 shares. As previously noted, a stock dropping to $0 is a rare occurrence but provides a theoretical max loss.

- Breakeven ($197): Calculated by subtracting the premium received ($3) from the strike price ($200). The stock needs to be at this price at expiration for the trade to neither make nor lose money.

Let’s look at a couple of potential outcomes:

Outcome A (Minor Bearish Move): Tesla’s stock drops slightly to $215 by expiration. The put option expires worthless as it’s out-of-the-money. Thus, you pocket the entire premium, leading to a profit of $300.

Outcome B (Major Bearish Move): Suppose Tesla’s stock price crashes to $195. The put option is in-the-money by $5. After considering the $3.00 premium you received initially, your net loss stands at $2.00 per share or $200 in total.

Key Points to Remember

Impact of Time Decay

Time decay, or theta, is one of the most important aspects of naked puts. As the expiration date approaches, the option’s extrinsic value deteriorates. This gradual reduction in an option’s value works in favor of sellers, as they benefit when the option they sold loses value.

Most sellers prefer to sell options around 30-60 days away from expiration. As expiration nears, time decay accelerates. This phenomenon is especially noticeable in the last 30 days leading up to expiration. While it might be tempting to sell options with a longer expiration for more premium, the slower time decay on those options typically makes them less attractive for option sellers.

Impact of Volatility

Volatility also plays a crucial role in options trading. The higher the volatility, the pricier the options contracts become. This is a result of the increased risk associated with more substantial stock price fluctuations.

Because of this, many option sellers seek stocks with higher implied volatility (IV) when selling puts, aiming to collect higher premiums. This can be measured using metrics like the IV Rank or IV Percentile. These provide insight into whether a stock’s current implied volatility is high or low in comparison to its historical levels.

Managing the Position

Generally, sellers tend to close their positions prior to expiration once they achieve a good portion of their potential profit, with many targeting around 50-75% of the maximum gain.

However, if the stock price starts approaching the short put’s strike price, you’re faced with a decision:

- Hold: By holding the position they maintain their bullish outlook. If the stock remains above the short strike through expiration, the trade can still end up profitable.

- Close Early: Some may opt to close the option by buying it back to avoid further risks.

- Roll the Option: Others might roll the option to a later expiration date or a lower strike, giving the position more time or room for the stock price to move favorably.

Should the option be assigned, the seller is then obligated to buy the stock at the strike price. At this point, they have several options:

- Sell to Close: Offload the stock immediately to realize any gains or limit losses.

- Hold the Stock: If you maintain a bullish outlook on the stock, you can hold onto it in anticipation of potential appreciation.

- Sell Covered Calls: For traders familiar with the wheel strategy, this is the next step. By selling covered calls against your stock, you can generate additional income and potentially have the shares called away at a profit.

FAQs

The main risk is the potential obligation to purchase the underlying asset at the strike price, regardless of how far the market price might fall below it. If the stock drops significantly below the strike price, losses can be substantial.

If your naked put option gets assigned, it means the buyer of the put option is exercising their right to sell the stock at the strike price. As the seller, you are obligated to buy the stock at that strike price, regardless of the current market price.

One common method is to purchase a further out-of-the-money put option, turning the naked put into a bull put spread. This limits potential losses but also reduces the potential profit.

Higher implied volatility (IV) generally results in higher option premiums. Thus, selling puts on stocks with high IV can yield more substantial premiums, although it comes with increased risk due to the stock’s higher potential for significant price swings.

Yes, selling naked puts is generally a bullish strategy. The seller anticipates the stock price will remain above the put’s strike price, allowing the option to expire worthless and the seller to keep the premium.