Capital gains play a crucial role in investing but can be confusing for beginners. In this guide, we’ll discuss everything about capital gains, from basic concepts to advanced strategies for lowering your taxes. So, let’s dive in and make the most of your investments!

What are Capital Gains?

When you sell an investment or property for more than you originally paid for it, you’ve got yourself a capital gain. Essentially, it’s the profits you make when an asset is sold at a higher price than the original cost.

Types of Capital Gains

Capital gains fall into two categories: short-term and long-term.

- Short-Term Capital Gains: Short-term capital gains occur when the asset sold was held for one year or less. These gains will be taxed at your ordinary income tax rate – which can be pretty high depending on your income level.

- Long-Term Capital Gains: Long-term gains occur when the asset sold was held for more than one year. They’re generally taxed at a lower rate than short-term gains – which is of course more appealing than paying higher taxes.

How Capital Gains Are Taxed

Capital gains taxes can have a significant impact on your investment returns. To better understand how capital gains are taxed, we will explore various aspects such as tax rates, deductions, and special circumstances related to capital gains taxation.

Short-Term Capital Gains Tax Rates

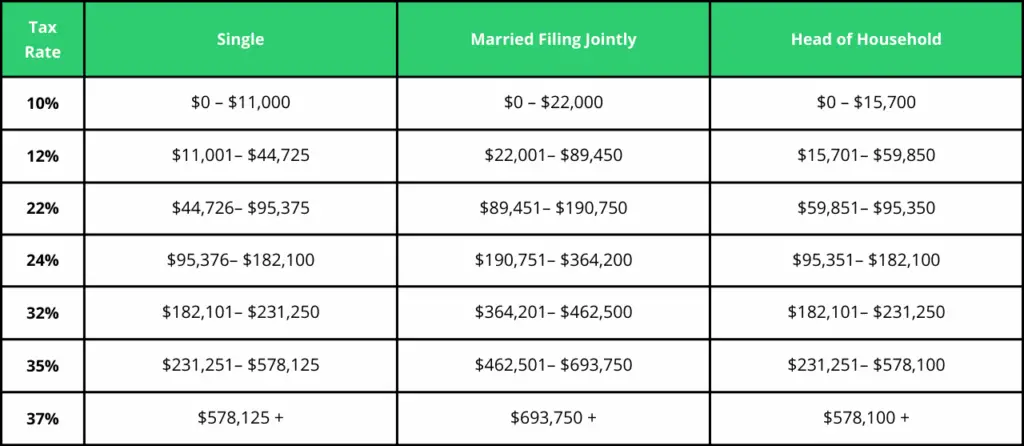

As we just mentioned, short-term capital gains are taxed at your ordinary income tax rate. That means it’s based on your taxable income and filing status. The table below gives you a better picture of tax rates for 2023.

Just remember these tax brackets change frequently, so you’ll need to verify the current rates based on the specific tax year in question.

Long-Term Capital Gains Tax Rates

Long-term capital gains enjoy more favorable tax rates compared to short-term capital gains. The tax rates for long-term capital gains depend on your taxable income and filing status. As of 2023, the long-term capital gains tax rates are as follows:

Again, please verify the current rates based on the tax year in question as these tax brackets change pretty much every year.

Capital Gains Tax Deductions and Special Circumstances

- Capital Losses: Capital losses can be used to offset capital gains, reducing your overall tax liability. If your capital losses exceed your capital gains, you can deduct up to $3,000 ($1,500 for married filing separately) of net capital losses from your taxable income. Any remaining losses can be carried forward to future years.

- Collectibles and Art: Long-term capital gains from the sale of collectibles, such as art, antiques, and rare coins, are generally subject to a higher maximum tax rate of 28%, rather than the standard 20% for other long-term capital gains. This higher rate applies when your taxable income exceeds the threshold for the 15% long-term capital gains tax rate.

- Qualified Small Business Stock (QSBS): If you have invested in a qualified small business stock (QSBS) and held it for more than five years, you may be eligible for a special tax exclusion. Under Section 1202 of the Internal Revenue Code, you can exclude up to 100% of the capital gains from the sale of QSBS, subject to certain limitations.

- Primary Residence Exclusion: If you sell your primary residence and meet specific requirements, you may qualify for a capital gains tax exclusion. Single taxpayers can exclude up to $250,000 of capital gains, while married taxpayers filing jointly can exclude up to $500,000. To qualify for this exclusion, you must have owned and used the property as your primary residence for at least two of the five years preceding the sale.

State Capital Gains Taxes

In addition to federal capital gains taxes, some states also impose their own capital gains taxes. State capital gains tax rates vary and can be levied as a flat rate or based on your income bracket. It’s crucial to understand the capital gains tax rates in your state and how they may impact your overall tax liability.

Strategies to Minimize Capital Gains Taxes

Minimizing capital gains taxes is essential for investors looking to maximize their investment returns. Here, we’ll take a look at a few strategies which can reduce a person’s capital gains tax liability.

- Hold Investments for the Long Term: As long-term capital gains are taxed at lower rates than short-term capital gains, holding your investments for over a year can significantly reduce your tax burden. Adopting a buy-and-hold strategy, rather than frequently buying and selling assets, can result in substantial tax savings.

- Tax-Loss Harvesting: Tax-loss harvesting involves selling underperforming investments at a loss to offset gains from other investments. By strategically realizing losses, you can reduce your overall capital gains tax liability. Keep in mind that the “wash-sale rule” prevents you from claiming a loss if you purchase a substantially identical asset within 30 days before or after selling the original investment at a loss.

- Investing in Tax-Advantaged Accounts: Utilizing tax-advantaged accounts, such as individual retirement accounts (IRAs) or 401(k)s, can help you defer or avoid capital gains taxes altogether. These accounts allow you to grow your investments tax-free or tax-deferred, depending on the type of account. Additionally, Health Savings Accounts (HSAs) and 529 College Savings Plans also offer tax advantages and can be used to invest for specific purposes.

- Utilizing the Primary Residence Exclusion: If you are planning to sell your primary residence, ensure that you meet the requirements for the primary residence exclusion. By living in the property for at least two of the five years preceding the sale, you can exclude up to $250,000 ($500,000 for married filing jointly) of capital gains from your taxable income.

- Selecting Tax-Efficient Investments: Some investments are more tax-efficient than others. For example, index funds and exchange-traded funds (ETFs) are often more tax-efficient than actively managed mutual funds, as they tend to generate fewer capital gains distributions. Additionally, investing in municipal bonds can provide tax-free interest income, which is exempt from federal and, in some cases, state and local taxes.

Key Takeaways

- Capital gains are profits earned from the sale of an asset, such as stocks, bonds, real estate, or other investments.

- There are two types of capital gains: short-term (held for one year or less) and long-term (held for more than one year).

- Capital gains are subject to different tax rates depending on the type of gain and your income level.

- Capital losses can be used to offset capital gains, reducing your overall tax liability.

- Strategies to minimize capital gains taxes include holding investments for the long term, tax-loss harvesting, gifting appreciated assets, and investing in tax-advantaged accounts.

FAQs

Short-term capital gains are taxed at your ordinary income tax rate, which ranges from 10% to 37%, depending on your income.

Long-term capital gains are subject to more favorable tax rates, which are 0%, 15%, or 20%, based on your income level.

Yes, you can use capital losses to offset capital gains, potentially reducing your overall tax liability. You can also deduct up to $3,000 of net capital losses from your taxable income each year.

Tax-loss harvesting is a strategy that involves selling investments at a loss to offset gains from other investments. This can help reduce your overall tax liability.